implies collections, payments and transfers from the basis of current and capital transactions in foreign means of payment and in KM between residents and non-residents in accordance with legal provisions.

For payments abroad or the account of a non-resident in the country, it is necessary:

submit a correctly completed payment order (Form 1450)

attach the document that is the basis of payment (invoice, pro-invoice, contract, etc.)

provide cover for order execution

You can submit a payment order:

personally

via eBBI/mBBI

Service prices are defined by the valid Fee Tariff for legal entities of the Bank. The Bank reserves the right to change the Tariff for risky or more complex transactions.

For payments abroad or the account of a non-resident in the country, it is necessary:

Submit a correctly completed payment order (Form 1450);

Attach the document that is the basis of payment (invoice, pro-invoice, contract, etc.);

Provide cover for order execution;

For natural persons, ensure cover for execution of orders in the currency in which the payment is made.

When filling out form 1450, it is mandatory to specify the beneficiary’s IBAN and SWIFT address of the beneficiary’s bank in order to avoid additional costs of foreign banks.

IBAN is a unique international identifier of a client’s bank account, determined in accordance with the international standards of the European Commission for Banking Standards ISO 13616. IBAN is entered without empty fields or spaces.

BIC – Bank Identifier Code or SWIFT address is a unique international identifier of a bank.

Costs for remittances abroad, OUR, SHA and BEN

OUR option: total banking costs in the country and abroad are borne by the principal.

SHA option: shared costs, so the principal paid the bank costs in his bank, and the other costs will be deducted by the bank in the execution chain from the amount sent to the user.

BEN option: the total costs of the transfer are borne by the recipient of the funds, so the principal has not paid the bank charges that will be charged to the beneficiary of the funds.

Payment order currency (order maturity) T+0, T+1 and T+2

We offer a service for the valuation of payment orders abroad, which is additionally charged in accordance with the applicable tariffs for services to legal and natural persons. If the client does not insist on a T+0 or T+1 payment order, the T+2 standard is automatically applied.

Clarification of terms:

T+0: order processing date = currency date

T+1: transaction date + 1 business day

T+2: transaction date + 2 working days

Datum valute za plaćanje naveden na nalogu 1450 | Vrijeme dostave naloga za plaćanje u BBI i/ili putem m/eBBI | Valuta plaćanja | Datum izvršenja u BBI |

| T+0; T+1 | samo do 10:00 | SEK, NOK, DKK, GBP… (osim EUR) | Datum primanja naloga |

| T+0 | samo do 12:00 | EUR | Datum primanja naloga |

| T+1 | samo do 13:00 | EUR | Datum primanja naloga |

| T+2 | samo do 15:00 | EUR, SEK, NOK, DKK, GBP… | Datum primanja naloga |

| T+2 | od 15:00 do 16.30 | EUR, SEK, NOK, DKK, GBP… | Sljedeći radni dan po primanju naloga |

| GC sa Srbijom | do 13:00 | EUR | Datum primanja naloga |

| GC sa Srbijom | od 13:00 do 16:30 | EUR | Sljedeći radni dan po primanju naloga |

Clearing with Serbia is a new product of the Bank that includes:

Fast processing and execution of transfers on the same day;

Inflow of money from Serbia without commission;

Minimal costs without the participation of intermediary banks from abroad.

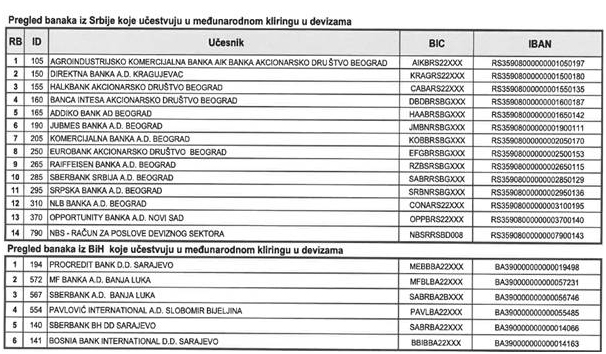

Banks participating in clearing with Serbia:

The client, user of eBBI/mBBI enters an order for payment abroad through the Bank’s electronic banking application.

The client submits the accompanying documentation by e-mail to platni@bbi.ba.

Note to clients:

To check the validity of invoices sent by e-mail from a foreign supplier, in order to protect your own interests and prevent possible interception of e-mails, we advise you to check by telephone, fax or VoIP (Skype, Viber, etc.), i.e. the channel you previously used to communicate with the foreign supplier , and never use contact information from a suspicious invoice.

Inflows from abroad are processed on the same day when the orders are received from the foreign bank, with the approval of the client’s account with the value date indicated on the order/the date when the Bank’s account with the current account abroad was approved.

The bank immediately credits the foreign currency inflow to the client’s account in the currency of the inflow and delivers the notification of the posted inflow to the client via e-mail.

In order to receive inflows from abroad as quickly and cheaply as possible, it is important that you provide the foreign partner with the correct payment instructions for inflows from abroad with the number of your foreign currency account, i.e. IBAN, our SWIFT address – BBIBBA22 and the intermediary foreign bank.

You can download payment instructions in the organizational part where you established a business relationship with the Bank. Complete and precise instructions make it easier to process inflows and make your funds available faster.

We appreciate your opinion

About us

Useful links

Customer support